AI Trading Platform Market size is growing at a CAGR of 20.7%

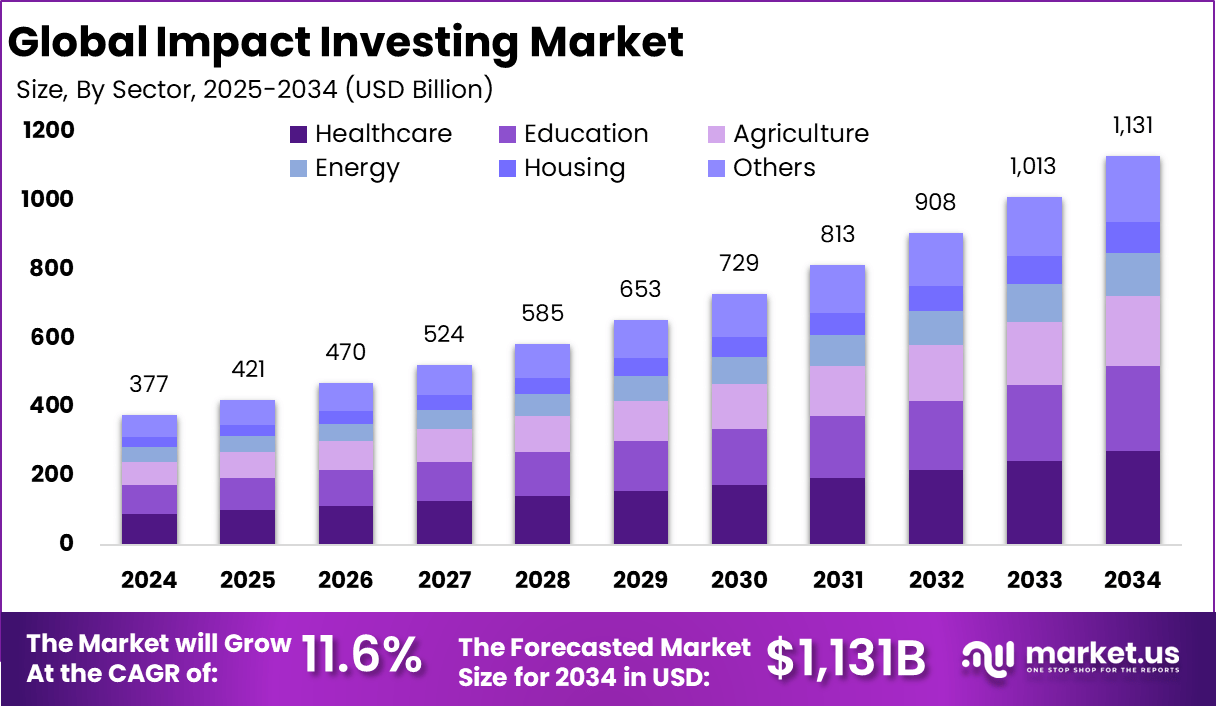

The Global AI Trading Platform Market size is expected to be worth around USD 75.5 Billion By 2034, from USD 11.5 billion in 2024, growing at a CAGR of 20.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.2% share, holding USD 4.2 Billion revenue.

Read more -

https://market.us/report/ai-trading-platform-market/

An AI trading platform market refers to the ecosystem of technologies, software, and services that leverage artificial intelligence to facilitate financial trading activities. These platforms use advanced algorithms, machine learning, and data analytics to automate trading processes, analyze market trends, and execute trades with precision. They cater to a wide range of users, from institutional investors like hedge funds to retail traders seeking accessible tools. The market encompasses cloud-based and on-premises solutions, mobile apps, and specialized tools for algorithmic trading, sentiment analysis, and risk management. It’s a dynamic space driven by the need for speed, accuracy, and efficiency in navigating complex financial markets.

The AI trading platform market, in terms of its market landscape, is experiencing robust growth, with projections estimating its value to reach significant milestones in the coming years. Valuations vary across reports, but the consensus points to a multi-billion-dollar industry expanding at a healthy compound annual growth rate. This growth is fueled by increasing demand from both institutional and retail investors, particularly in North America, which holds a dominant share due to its advanced financial infrastructure and tech innovation hubs. The market is competitive, with major players investing in research and development to enhance platform capabilities, while startups focus on niche solutions like personalized trading strategies.

Top driving factors for this market include the surge in demand for real-time data processing and the growing complexity of financial markets. Traders need tools that can analyze vast datasets instantly, and AI platforms deliver by identifying patterns and opportunities faster than humans. The rise of retail investing, spurred by accessible mobile apps, is another key driver, as is the push for cost efficiency, with firms like sovereign wealth funds adopting AI to reduce trading expenses. Advancements in computing power and data availability further accelerate market expansion, enabling platforms to handle increasingly sophisticated tasks.

AI Trading Platform Market size is growing at a CAGR of 20.7%

The Global AI Trading Platform Market size is expected to be worth around USD 75.5 Billion By 2034, from USD 11.5 billion in 2024, growing at a CAGR of 20.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.2% share, holding USD 4.2 Billion revenue.

Read more - https://market.us/report/ai-trading-platform-market/

An AI trading platform market refers to the ecosystem of technologies, software, and services that leverage artificial intelligence to facilitate financial trading activities. These platforms use advanced algorithms, machine learning, and data analytics to automate trading processes, analyze market trends, and execute trades with precision. They cater to a wide range of users, from institutional investors like hedge funds to retail traders seeking accessible tools. The market encompasses cloud-based and on-premises solutions, mobile apps, and specialized tools for algorithmic trading, sentiment analysis, and risk management. It’s a dynamic space driven by the need for speed, accuracy, and efficiency in navigating complex financial markets.

The AI trading platform market, in terms of its market landscape, is experiencing robust growth, with projections estimating its value to reach significant milestones in the coming years. Valuations vary across reports, but the consensus points to a multi-billion-dollar industry expanding at a healthy compound annual growth rate. This growth is fueled by increasing demand from both institutional and retail investors, particularly in North America, which holds a dominant share due to its advanced financial infrastructure and tech innovation hubs. The market is competitive, with major players investing in research and development to enhance platform capabilities, while startups focus on niche solutions like personalized trading strategies.

Top driving factors for this market include the surge in demand for real-time data processing and the growing complexity of financial markets. Traders need tools that can analyze vast datasets instantly, and AI platforms deliver by identifying patterns and opportunities faster than humans. The rise of retail investing, spurred by accessible mobile apps, is another key driver, as is the push for cost efficiency, with firms like sovereign wealth funds adopting AI to reduce trading expenses. Advancements in computing power and data availability further accelerate market expansion, enabling platforms to handle increasingly sophisticated tasks.