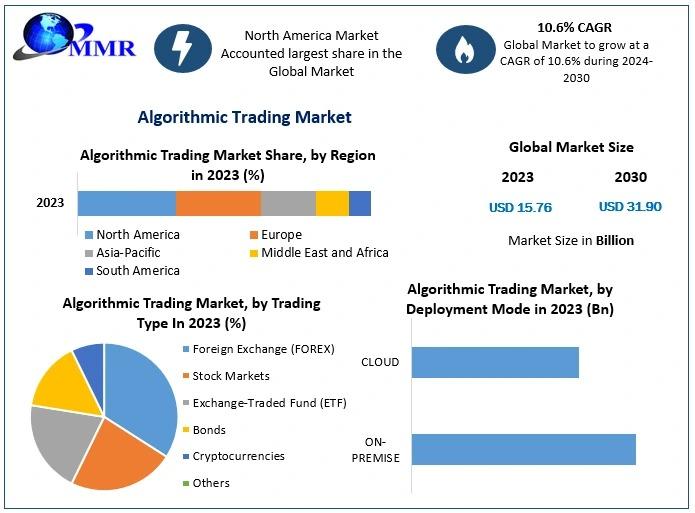

Unveiling Key Drivers of the Algorithmic Trading Market

The financial world is undergoing a significant transformation, and at the heart of this shift is the rapidly growing Algorithmic Trading Market. Once the domain of elite hedge funds and investment banks, algorithmic trading has now become a mainstream strategy for institutional and even retail investors, thanks to advances in technology, increased data availability, and the democratization of financial tools.

What is Algorithmic Trading?

Algorithmic trading, also known as algo trading or automated trading, involves the use of computer programs to execute trades at high speed and frequency based on predefined criteria such as price, timing, volume, and other mathematical models. These algorithms can react to market changes in milliseconds, enabling traders to exploit opportunities that would be invisible to the human eye.

Market Growth and Trends

The global algorithmic trading market has been on an upward trajectory, driven by the surge in demand for fast, efficient, and data-driven trading solutions. In recent years, the market has seen impressive growth, and it is projected to continue expanding as financial institutions invest heavily in AI and machine learning to enhance trading accuracy and profitability.

One notable trend is the increasing adoption of cloud-based platforms for algorithm development and backtesting. These platforms offer scalability and computational power that traditional on-premise solutions can't match, making them attractive to both emerging fintech firms and established financial giants.

Another significant trend is the integration of natural language processing (NLP) into algorithmic strategies. With NLP, trading systems can analyze news feeds, earnings reports, and social media sentiment in real time, incorporating this qualitative data into trading decisions.

Key Drivers of Market Expansion

Several factors are contributing to the explosive growth of the algorithmic trading market:

-

Technological Advancements: The rise of big data analytics, high-frequency trading infrastructure, and AI has made it easier to design complex trading algorithms.

-

Regulatory Encouragement: In many regions, governments and financial regulators are embracing technology to increase transparency and reduce human error.

-

Institutional Adoption: Banks, asset managers, and hedge funds are rapidly shifting to algorithmic models to reduce costs and improve execution speeds.

-

Retail Trading Boom: With user-friendly platforms and commission-free trading, retail investors are also exploring algorithmic strategies, particularly in crypto and forex markets.

Challenges and Opportunities

Despite its many advantages, algorithmic trading comes with challenges. Market volatility, system errors, and the risk of flash crashes are ever-present concerns. Additionally, regulatory scrutiny is increasing, especially around high-frequency trading and the use of proprietary algorithms that may create market imbalances.

However, the opportunities far outweigh the risks. As machine learning models become more sophisticated, they can adapt and evolve in real time, allowing for predictive analytics that anticipates market shifts before they happen.

The Road Ahead

The future of algorithmic trading lies in greater automation, smarter algorithms, and tighter integration with alternative data sources. From ESG metrics to satellite imagery, tomorrow’s trading decisions may be based on inputs far beyond traditional financial indicators.

Conclusion

The Algorithmic Trading Market Size is not just a trend—it’s a fundamental shift in how global markets operate. For those who can master the technology and manage the risks, the rewards are substantial and growing.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness