Mobile Money Market in Emerging Economies: A Gateway to Financial Empowerment

Mobile Money Market Overview

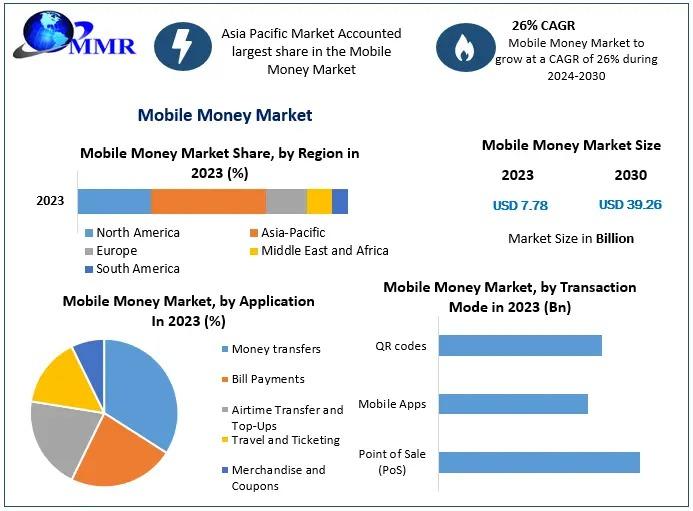

The mobile money market size is transforming how people manage finances across the globe. With the rapid increase in smartphone penetration and digital financial literacy, mobile money has emerged as a key financial tool, particularly in developing regions. This fintech innovation enables users to perform financial transactions using mobile devices, eliminating the need for traditional banking infrastructure and significantly boosting financial inclusion.

The global mobile money market is experiencing robust growth, driven by increased demand for secure, convenient, and fast payment systems. From peer-to-peer transfers to bill payments and merchant transactions, mobile money services are expanding their offerings and user base. Governments and financial institutions are also endorsing mobile money as a solution to bridge the financial divide, especially in underserved and remote areas.

Trends Shaping the Market

-

Integration with e-wallets and super apps

-

Adoption of blockchain and AI for secure transactions

-

Expansion into rural and semi-urban markets

-

Collaborations between telecom and financial sectors

-

Cross-border mobile payments and remittances

Benefits of Mobile Money

-

Financial inclusion: Provides banking access to previously unbanked populations.

-

Convenience and speed: Transactions can be made anytime, anywhere.

-

Cost-efficiency: Reduces transaction fees and infrastructure costs.

-

Security: Enhanced authentication and encryption technologies protect user data.

-

Business empowerment: Facilitates digital payments and boosts micro and small businesses.

Challenges in the Industry

-

Cybersecurity threats: Growing reliance on digital platforms increases exposure to cyber risks.

-

Regulatory concerns: Diverse financial regulations across countries pose compliance challenges.

-

Digital illiteracy: Limited tech skills can hinder adoption in certain regions.

-

Infrastructure issues: Areas with weak mobile or internet connectivity face access barriers.

-

Fraud and scams: Misinformation and phishing attempts can exploit vulnerable users.

Market Segmentation

-

By Transaction Type: Person-to-person, person-to-business, business-to-business, international remittance

-

By Technology: STK/USSD, mobile apps, NFC, QR codes

-

By Application: Bill payments, money transfers, airtime top-ups, insurance, loans

-

By End-User: Individuals, enterprises, government

Regional Insights

-

Asia Pacific leads the global market due to high mobile penetration and tech adoption.

-

Africa is a trailblazer in mobile money with services like M-Pesa transforming local economies.

-

Latin America and the Middle East are also experiencing rapid mobile money growth.

-

North America and Europe are expanding mobile money in tandem with the growth of contactless payments and digital banking.

Key Players

-

Vodafone Group

-

Orange S.A.

-

Bharti Airtel

-

MTN Group

-

PayPal Holdings Inc.

-

Western Union Holdings

-

Google Pay

-

Apple Pay

-

Samsung Pay

-

Ant Financial Services

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness